Fascination About Pacific Prime

Fascination About Pacific Prime

Blog Article

Pacific Prime - Questions

Table of ContentsEverything about Pacific PrimeAbout Pacific PrimeGetting My Pacific Prime To WorkThe Definitive Guide to Pacific PrimeUnknown Facts About Pacific Prime

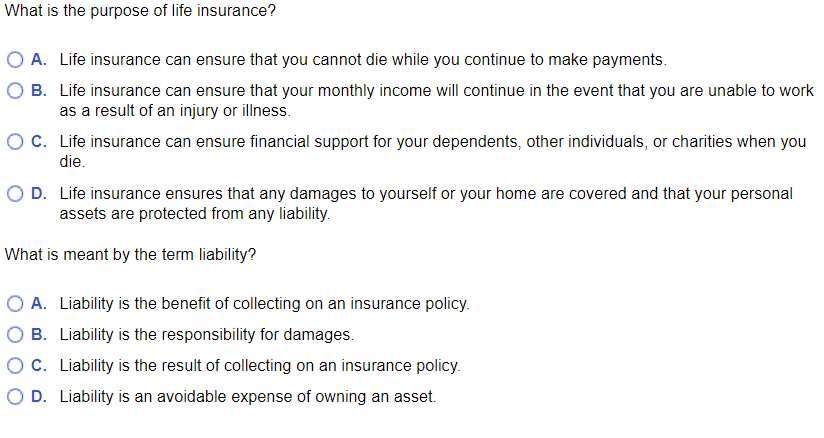

Insurance policy is an agreement, represented by a policy, in which an insurance policy holder obtains economic defense or compensation against losses from an insurer. The company pools clients' risks to pay extra budget-friendly for the guaranteed. Most individuals have some insurance: for their automobile, their residence, their health care, or their life.Insurance coverage additionally helps cover prices associated with obligation (legal duty) for damage or injury caused to a third celebration. Insurance is a contract (plan) in which an insurance firm indemnifies an additional against losses from particular contingencies or perils. There are several sorts of insurance plan. Life, health, homeowners, and auto are amongst one of the most usual types of insurance policy.

Investopedia/ Daniel Fishel Numerous insurance plan kinds are offered, and virtually any kind of private or service can discover an insurance firm prepared to guarantee themfor a price. The majority of individuals in the United States have at least one of these kinds of insurance coverage, and vehicle insurance policy is needed by state legislation.

The Main Principles Of Pacific Prime

Finding the price that is appropriate for you calls for some legwork. The plan limitation is the maximum amount an insurance firm will certainly pay for a protected loss under a policy. Optimums might be established per duration (e.g., annual or policy term), per loss or injury, or over the life of the plan, also understood as the life time maximum.

Policies with high deductibles are typically less costly because the high out-of-pocket cost usually causes fewer tiny insurance claims. There are numerous various kinds of insurance. Allow's check out the most vital. Medical insurance aids covers routine and emergency clinical care prices, usually with the choice to include vision and dental solutions independently.

Numerous precautionary solutions might be covered for free before these are fulfilled. Wellness insurance policy might be acquired from an insurance business, an insurance coverage representative, the government Health Insurance policy Industry, offered by a company, or federal Medicare and Medicaid coverage.

Not known Details About Pacific Prime

Rather than paying of pocket for vehicle mishaps and damage, people pay yearly premiums to a car insurance provider. The firm then pays all or most of the covered expenses related to an auto crash or various other car damage. If you have a leased automobile or borrowed cash to buy a cars and truck, your loan provider or leasing car dealership will likely require you to bring car insurance.

A life insurance coverage policy warranties that the insurer pays an amount of money to your beneficiaries (such as a spouse or kids) if you die. In exchange, you pay costs throughout your lifetime. There are 2 major sorts of life insurance policy. Term life insurance policy covers you for a specific duration, such as 10 to two decades.

Permanent life insurance policy covers your entire life as long as you continue paying the premiums. Traveling insurance policy covers the prices and losses connected with traveling, including trip cancellations or delays, protection for emergency healthcare, injuries and emptyings, harmed baggage, rental cars, and rental homes. Even some of the best travel insurance business do not cover cancellations or delays as a result of weather, terrorism, or a pandemic. Insurance policy is a method to handle your economic risks. When you get insurance policy, you check over here purchase protection against unexpected monetary losses. The insurance company pays you or a person you choose if something negative happens. If you have no insurance policy and a mishap occurs, you might be accountable for all related costs.

How Pacific Prime can Save You Time, Stress, and Money.

Although there are several insurance plan types, some of one of the most common are life, wellness, homeowners, and car. The appropriate sort of insurance policy for you will depend on your objectives and economic circumstance.

Have you ever before had a minute while looking at your insurance plan or purchasing for insurance when you've believed, "What is insurance policy? Insurance can be a mysterious and perplexing point. How does insurance policy work?

Suffering a loss without insurance policy can place you in a tough monetary circumstance. Insurance coverage is an essential monetary tool.

Some Known Details About Pacific Prime

And in many cases, like auto insurance coverage and workers' settlement, you may be required by regulation to have insurance policy in order to safeguard others - international health insurance. Discover ourInsurance alternatives Insurance policy is essentially a massive wet day fund shared by lots of people (called insurance holders) and handled by an insurance service provider. The insurance provider makes use of money collected (called costs) from its insurance policy holders and various other financial investments to pay for its procedures and to accomplish its assurance to insurance policy holders when they sue

Report this page